Since the Fed has 'become active' there appears to be quite a bit more volatility!

Wonder what effect Nixon's removing the US from the gold standard played in the opportunity for more volatility (although it looks like we were already on our way!)?

Submitted by Lance Roberts of Street Talk Live,

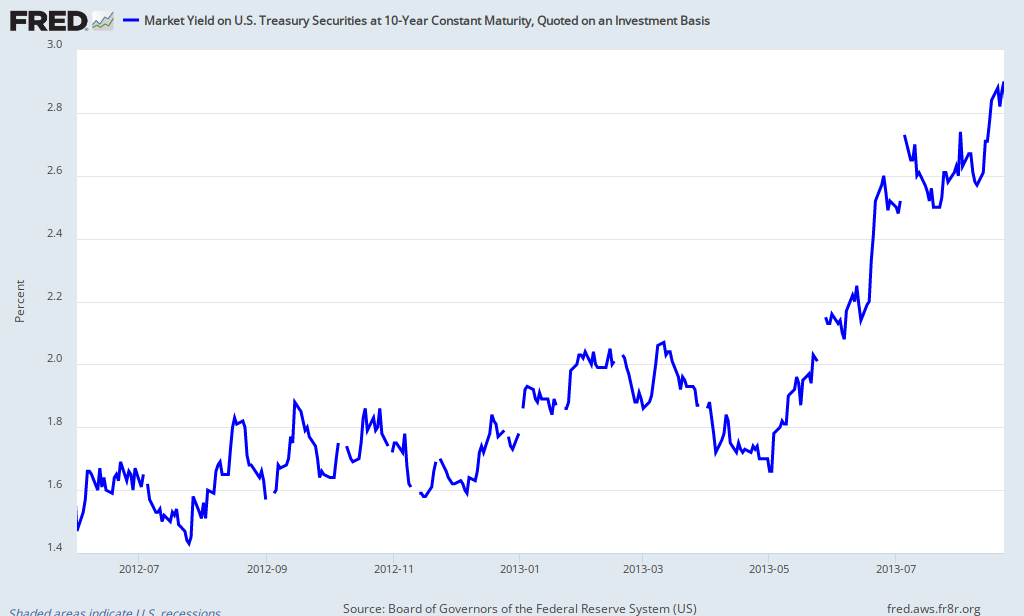

This is the long term view on interest rates. The chart shows both the "Fed Funds" equivalent short term rate versus long term interest rates. There has been much discussion as of late about the need for interest rates to rise as they have been historically way too low for too long. However, is that really the case?

The average long term interest rate in the U.S. has been 5.49% (median is 4.91%) since 1854. However, that average rate would be much lower if the "spike" in interest rates in the 1960's and 70's were removed which would mean that the current long term interest rate is likely more aligned currently with historical norms. This is particularly the case when compared to the much slower rates of economic growth that currently exists. However, the current equivalent "Fed Funds" rate is at a level that is historically out of context and was only seen during the "The Great Depression."

There is some interesting context when discussing Pre- and Post-WWII economies. Prior to WWII the U.S. economy was primarily agricultural and primarily domestic with few exports. This led to much more frequent recessions due to weather, lack of transport and infrastructure, etc. However, after WWII ended, the U.S. became a massive power house of industrial production and manufacturing as domestic demand flourished and the U.S. engaged in rebuilding Western Europe and Japan.

The steady climb in interest rates through the late 70's coincided with steadily increasing rates of economic growth. The Federal Reserve began to become much more proactive in the management of monetary policy during this period and the steadily increasing strength of the economy, incomes and savings rates suggested that Keynesian economic theories were functioning properly. Normal economic recessions, which began to occur at a slower rate, were softened by Fed policy. However, it is important to notice that drops in interest rates to spur economic activity never dropped below the rate that existed prior to the last recession.

As the economic makeup shifted from one of production and manufacturing to a service, credit and finance based economy beginning in 1980, the economic cycle changed from one of steadily increasing to decreasing rates of growth. This change in economic makeup potentially exposed the flaws in previous economic theories as each manipulation of interest rates has continued fall to lower levels. This continued drive to lower rates has kept a weakening economy running from boom to bust and now, with rates near the zero line, there is no room left to soften the next eventual recession.

This is what I find most interesting with regard to the ongoing discussions about whether or not the U.S. is in a recession. The reality is that such discussions are relatively pointless in the broader context. The "Great Depression" was not just one very long "recessionary" period but rather two recessions that "bookended" a period of relatively strong economic growth. However, interest rates were unable to rise for over a decade as the "depression" on "Main Street" was far more real than the economic statistics revealed. It is possible that in 30 or 40 years, as we look back at current history, we will indeed label the current period as the second depression. While there indeed may not be "bread lines" on street corners it is only because the "nutritional assistance" comes in the mailbox.